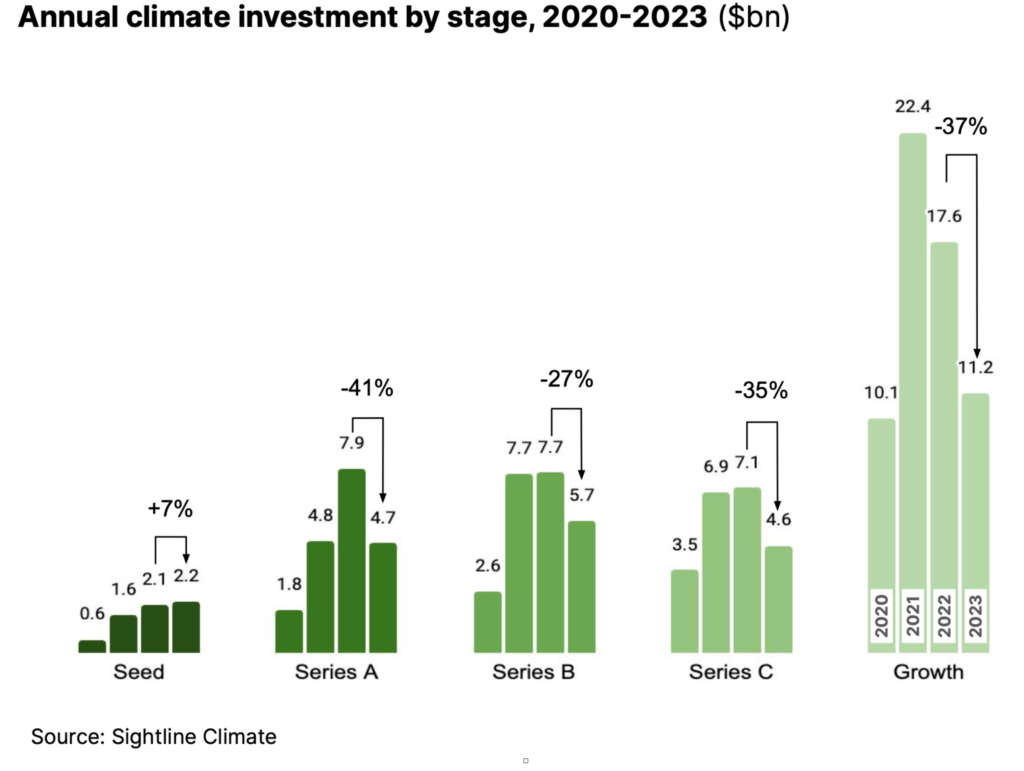

While 2023 saw whispers of a slowdown in climate tech funding, a closer look reveals a fascinating story of resilient innovation, not retreat. While overall VC funding dipped, early-stage startups saw a 7% increase in seed investments. This shift in investor focus speaks volumes: in a cautious market, these agile pioneers offer a potent blend of boundless potential and calculated risk, perfectly suited to navigate uncertain waters.

Unlike their later-stage counterparts, burdened with established models and less explosive upside, these startups possess the inherent adaptability to thrive in this turbulent climate. Their lean structures and disruptive ideas hold the promise of exponential growth and transformative impact, bridging the gap between scientific breakthroughs and real-world solutions.

This trend creates a unique opportunity for academia-backed startups. Their rigorous research pipelines provide a solid foundation for future success. By translating cutting-edge research into commercially viable solutions, these ventures can bridge the gap between scientific breakthroughs and real-world impact.

But navigating this evolving landscape requires strategic finesse. Capital efficiency is paramount, demanding a clear path to commercialization and compelling narratives that resonate with investors seeking both environmental impact and financial returns. Embracing alternative funding avenues, like grants, blended capital, and debt financing, can also unlock crucial resources for these budding green unicorns and gigacorns.

The data paints a clear picture: Series A, B, and C funding saw significant declines, highlighting investors’ preference for de-risked business models and proven track records. This presents a unique opportunity for academia-backed startups, whose rigorous research and development pipelines provide a solid foundation for future success. By translating cutting-edge research into commercially viable solutions, these ventures can bridge the gap between scientific breakthroughs and real-world impact.

Despite the temporary funding shift, the future of climate tech remains undeniably bright. The World Economic Forum’s Net-Zero Industry Tracker 2023 report outlines the urgent need for $13.5 trillion in investments by 2050, particularly in hard-to-abate industries like steel, cement, aviation, and others, which emit a staggering 40% of global greenhouse gases. This highlights the immense potential of early-stage startups to provide innovative solutions for these critical sectors and lead the charge towards a net-zero future in 2024 and beyond.